32+ how to deduct mortgage interest

Your mortgage lender sends you a Form 1098 in January or early February. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Mortgage Interest Deduction Youtube

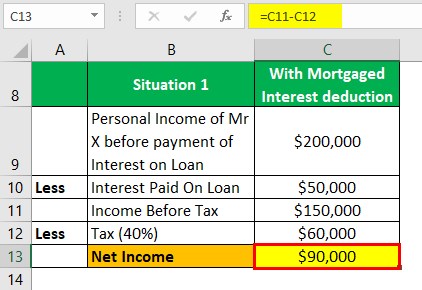

Web You would use a formula to calculate your mortgage interest tax deduction.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Itemized deductions include amounts you paid for state and local income or sales taxes real.

In addition to itemizing these conditions must be met for mortgage interest to be. Web What deductions can I claim in addition to standard deduction. Your mortgage lender should send.

Ad For Simple Returns Only. Lest assume we paid 60k in. Web The total amount of your mortgage interest is only tax deductible if you rent out your entire property for the entire year.

Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Look in your mailbox for Form 1098.

Our Tax Experts Will Help You File Fed and State Returns - All Free. Web How to claim the mortgage interest deduction. And lets say you also paid 2000 in mortgage insurance premiums.

However higher limitations 1 million 500000 if. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 1 million of mortgage debt. Mortgage interest is claimed on Schedule A Line 8.

1 2018 youre allowed to deduct the interest paid on up to 1 million of home acquisition debt plus 100000 of home. The co-owner is a spouse who is on the same return. So your total deductible mortgage.

Normal-Tah 51 min. Homeowners who bought houses after Dec. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. If this is not the case only the portion of. Web Heres how to claim the mortgage interest deduction.

Web Most homeowners can deduct all of their mortgage interest. Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web 1 day agoThe APR or annual percentage rate on a 20-year fixed mortgage is 710 compared to 722 at this time last week. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Web So lets say that you paid 10000 in mortgage interest.

Web There are different situations that affect how you deduct mortgage interest when co-owning a home. For example a taxpayer with mortgage principal of 15 million on. See If You Qualify To File 100 Free w Expert Help.

At the current interest rate of 708 a 20. Web You cant deduct the principal the borrowed money youre paying back. Web If you took out your mortgage before Jan.

It reduces the amount of your income that is taxed. Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid. Your mortgage lender is required to provide a 1098.

Web To qualify for the home mortgage interest deduction you must have a qualified residence and the mortgage must be secured by that residence. Web The tax deduction doesnt refund your interest payment to you. To get an estimate and breakdown of your interest.

A Guide To Mortgage Interest Deduction Quicken Loans

Mortgage Interest Deduction Bankrate

Administrative Expenses Meaning List Real Company Examples

Mortgage Interest Deduction Changes In 2018

Getting A Mortgage After Bankruptcy And Foreclosure

Mortgage Interest Deduction Bankrate

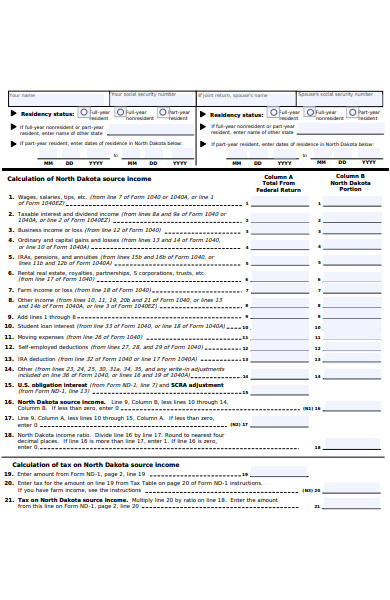

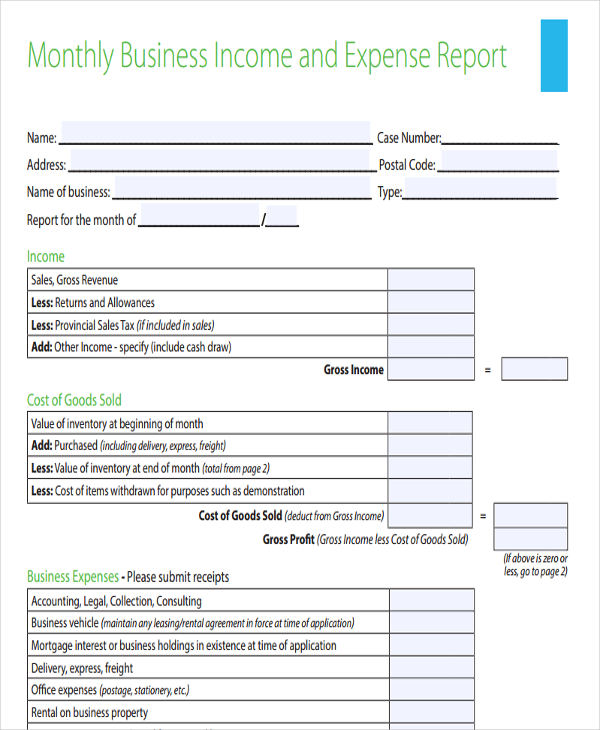

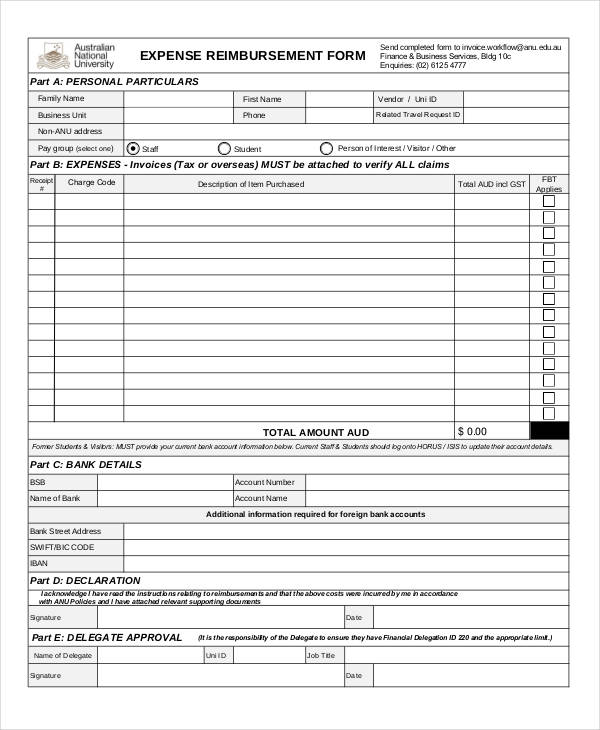

Free 31 Calculation Forms In Pdf Ms Word

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Sec Filing Agilethought

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

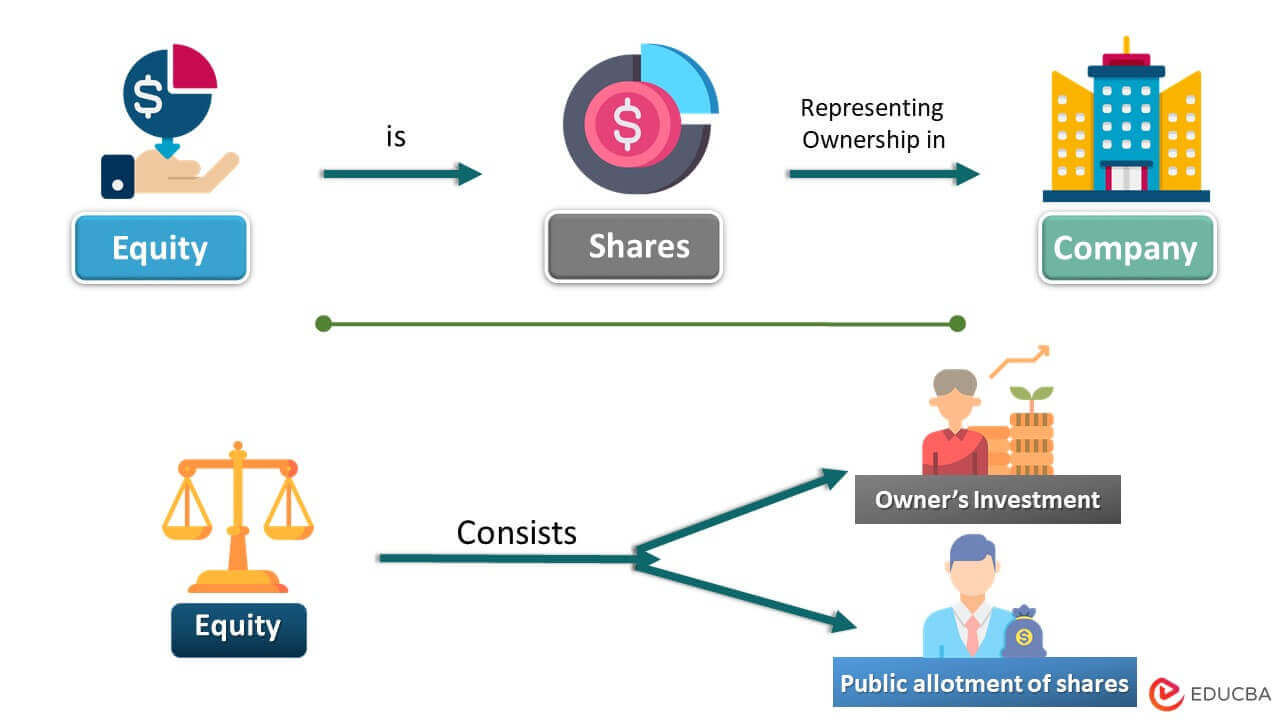

Equity Meaning Formula Examples Calculation Importance

49 Monthly Report Format Templates Word Pdf Google Docs Apple Pages

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Free 32 Claim Form Templates In Pdf Excel Ms Word

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep